About Us

-

Building the best frontier tech fund.

frontier technology, frontier productivity, frontier lifestyle – all for a better society.

Introduction to Linear Capital

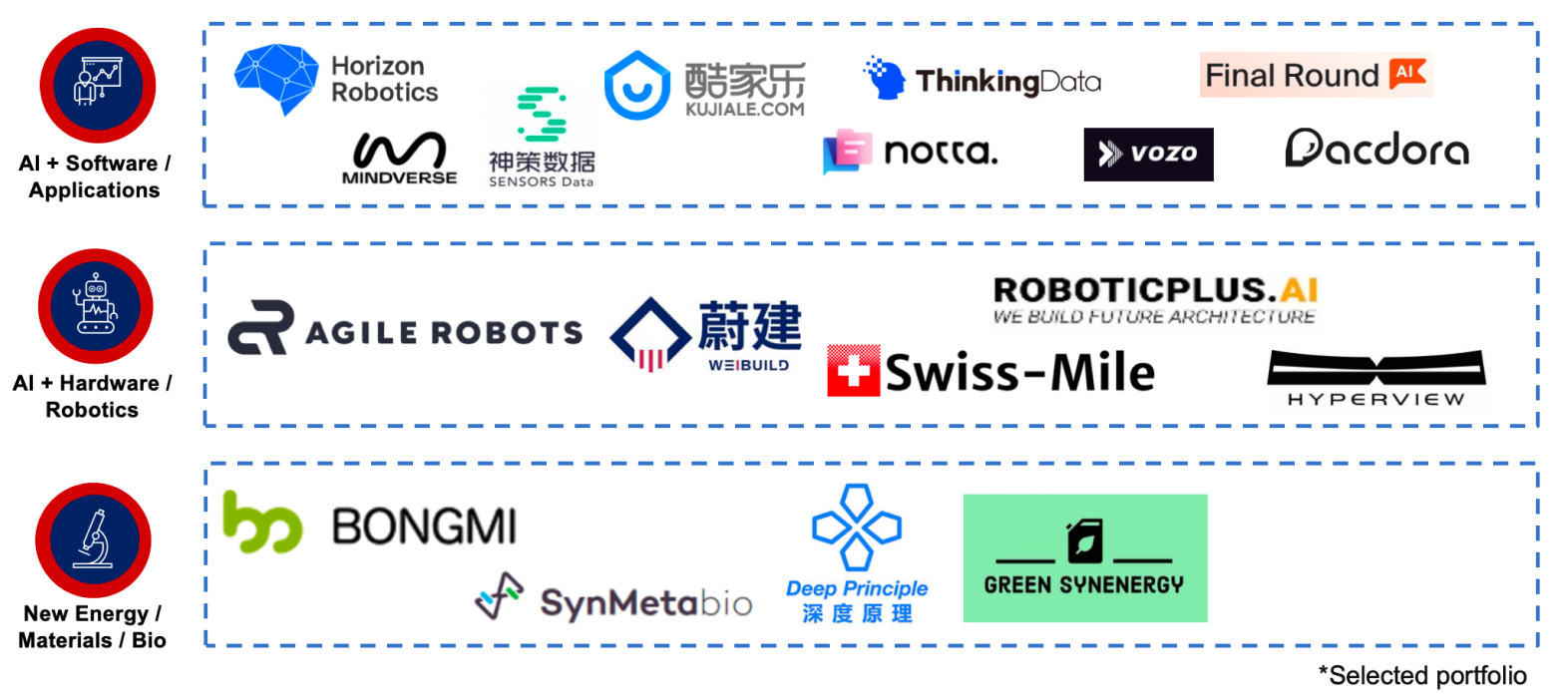

Linear Capital was founded in 2014 and has been focusing on investing in the space of “frontier technology + industry”, that is, frontier technology represented by data intelligence, next-generation infrastructure, next-generation robot technology, and technological transformations of traditional industries such as biomedicine, materials, energy, etc. Frontier technology is applied to various verticals to significantly improve industry productivity, solve the pain points, complete industry upgrading, and achieve attractive returns by substantially increasing industry value. Linear Capital persists in investing in the early stage and providing support throughout the investment life cycle. At present, Linear Capital is managing ten funds with a total AUM of about US$2 billion. Linear Capital has invested in the early stage of more than 150 entrepreneurial teams including Horizon Robotics, Agile Robots, Kujiale, Sensors Data, Tezign, EHang which are all unicorns now. The total valuation of Linear Capital’s portfolio companies is estimated to be about US$20 billion.

Our LPs

Among the long-term investors that we work closely with, there are top global university endowments, largest sovereign wealth funds, professional investment institutions/FoFs, leading enterprises from multiple business sectors, founders of well-known technology startups, and prestigious family offices all over the world.

Investment Stage

Our initial investment stage mainly focuses on Series Angel and Series Pre-A, occasionally Series A. We come in early and support for long. For each single dollar we initially invest, we are well prepared to make follow-on investment in the long run.

Check Size

We can invest US$1M-10M as initial investment.

Post-Investment Services

- Key Strategy Advising: to give portfolio companies advice in key discussions during core product iteration, market expansion, and commercialization.

- Key Position Hiring: to help portfolio companies recruit key positions. For example, we helped Horizon Robotics and Agile Robots recruit CTO.

- Key Round Financing: to help portfolio companies complete the subsequent rounds of financing.

- Key Client Conversion: to connect portfolio companies with appropriate customer resources and gradually convert to business cooperation.

- Key Moment Branding: to help portfolio companies establish market branding with industry influence, success stories, awards, etc., in order to create positive impacts in the process of financing, business development, and talent recruitment.